santa clara property tax appeal

Fast Easy Secure. Parcel Boundary Change Request.

Secured Property Taxes Treasurer Tax Collector

Sign and date the form and submit online or by mail.

. CA State Board of Equalization Publication 29 California Property Tax An Overview CA State Board of Equalization Publication 30 Residential Property Assessment Appeals Change of Address Request Form Fill-in. See reviews photos directions phone numbers and more for County Property Tax Appeal Spe locations in Santa Clara CA. Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the 3143 counties in order of median.

In Santa Clara County owners of one to four family dwellings can appeal before a tax appeal board or a value hearing. Welfare Exemption Claim Form BOE-267. I would recommend them anytime for tax appeal needs.

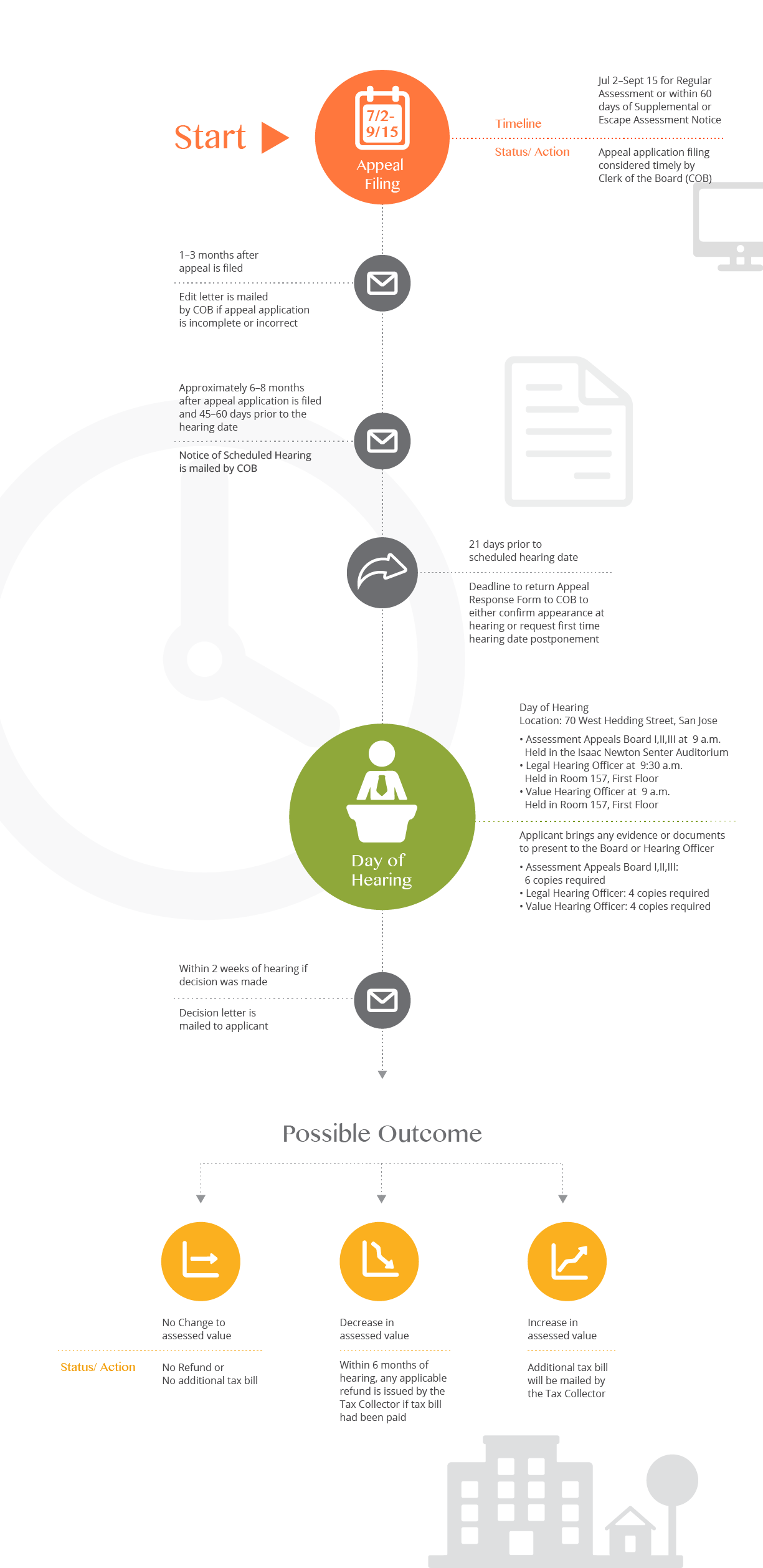

Karthik saved 38595 on his property taxes. Please note the review process may take 45-90 days. In Santa Clara County a Notification of Assessed Value indicating the taxable value of each property is mailed via postcard at the end of June to all property owners.

Introduction The property taxes you pay are based on your propertys assessed value as determined by your County Assessor. Appeal of Administrative of Architectural Committee or Planning Commission Decisions Form PDF Last Updated. The process was simple and uncomplicated.

They may have appealed their property tax before. It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. Property Tax Department Subject.

Corporations and homeowners have the right to appeal property tax assessments. Or Proposition 60 which is similar to Proposition 13 but lets the homeowner transfer this tax base to a new property in a different county. A taxpayer who disagrees with the assessed value on the Notification Card may request a review by presenting to the Assessors Office by August 1 of the current assessment.

Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax. They benefited from Proposition 13 which lets a longtime homeowner transfer their property tax to a new property even though it has a higher tax assessment. See reviews photos directions phone numbers and more for County Property Tax Appeal locations in Santa Clara CA.

Save Time Editing Documents. Get peer reviews and client ratings. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

Edit PDF Files on the Go. Assessment Appeals Division 70 West Hedding Street East Wing 10th Floor San Jose CA 95110 Phone. Kern November 30 Santa Cruz November 30 Kings.

Find a local Santa Clara California Property Tax Appeals attorney near you. Agricultural Preserve Williamson Act Questionnaire. The article denotes recent increases in value and projected increases in the immediate future citing recent developments in the early stages of COVID-19.

I had a fantastic experience getting my property tax deal processed through TaxProper. Assessment Appeal Application form. Disaster or Calamity Relief Section 170 Print Mail Form.

Proposition 13 the property tax limitation initiative was approved by California voters in 1978. Appeal Response Form WithdrawalContinuanceWaiver Request - DocuSign Online Submission. If you have questions or need assistance please call 408 808-7900 from 900 AM to 400 PM on Monday-Friday or email at DTAC-CancelPenaltyfin.

County Assessment Appeals Filing Period for 2021 Created Date. Looking for the best property tax reduction consultant in Santa Clara California to help you with property tax appeal. February 2020 Residential Property Assessment Appeals 1.

January 2022 At the end of December 2021 Santa Clara County Assessors office officials commented on the state of property valuation in light of the impact COVID-19 has had on real estate in the area. The regular appeals filing period will begin on July 2 2021 in each county and will end either on September 15 or. Property taxes are levied on land improvements and business personal property.

REDUCE PROPERTY TAXES. Find the right Santa Clara Property Tax Appeals lawyer from 2 local law firms. Ad Robust web-based PDF editing solution for businesses of all sizes.

Santa Clara County repeals fee for property assessments. TaxProper did a great job answering any questions I had about the process and their service. Browse HouseCashins directory of Santa Clara top tax advisors and easily inquire online about their property tax protest consulting services.

Attach documentation that supports the basis of your request to cancel your tax penalty. If you disagree with the Assessors value you can usually appeal that value to your local assessment appeals board or county board of equalization. Acknowledging the unfairness of a taxpayer winning a property tax assessment appeal but not receiving a refund of the fee required to file the appeal Supervisor Simitian led the Board in eliminating the fee for filing an appeal altogether.

Santa Clara County Tax Appeal. Choose from 3 attorneys by reading reviews and considering peer ratings.

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Assessment Appeals Exemptions Online Application Template Ast

Property Taxes Department Of Tax And Collections County Of Santa Clara

Secured Property Taxes Treasurer Tax Collector

Assessment Appeal Process Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Property Tax Assessment Appeals Exemptions Online Application Template Ast

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Commercial Property Tax Solutions Corelogic

Eagle Roofing 3603 Capistrano Sanborn Blend 3 Tile Rolled Mediterranean Style Home Exterior Color Schemes Mediterranean Style

California Public Records Public Records California Public

Assessment Appeals Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Properties Luxury Real Estate Mansions For Sale Florida Mansion Mansions Lakefront

Secured Property Taxes Treasurer Tax Collector

Istikbal Elita Gray Sofa Elita 6227d In 2022 Sofa Bed With Storage Convertible Sofa Bed Furniture

Business Property Tax In California What You Need To Know