when are property taxes due in kane county illinois

Clerk of the Circuit Court 540 South Randall Road St. The second installment of 2021 property tax bills are due on or before.

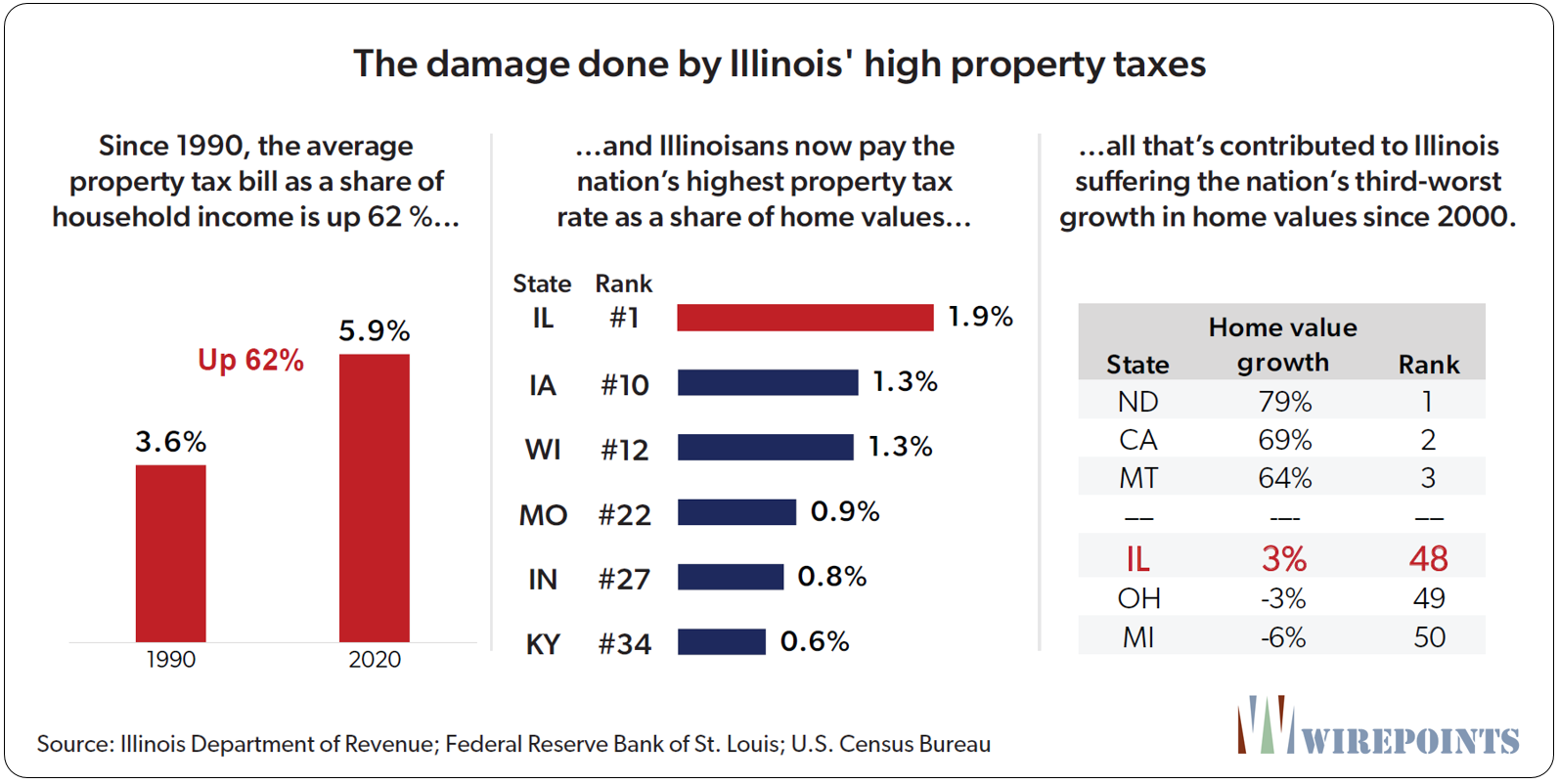

Local Governments Can Max Out Property Tax Levy Increases This Year Will They

In most counties property taxes are paid in two.

. WILL COUNTY WLS -- Residents and business owners in Will and Kane counties are worried about the thousands of dollars in property tax payments soon to be due amid the. There is a convenience fee for paying online. So if you pay on the due date your payment must reach.

The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill. Kilbourne mba announces that 2020 kane county real estate tax bills that are payable in 2021 will be mailed on april 30 2021. I had a fantastic experience getting my property tax deal processed through TaxProper.

Charles Illinois 60174 630-232-3413 Mon-Fri 830AM-430PM. An assessor from the countys office determines your real estates value. Yes you can pay your property tax with a credit or debit card.

630-208-7549 Office Hours Monday Thru Friday. Bldg A Geneva IL 60134 Phone. PROPERTY TAX DUE DATE REMINDER KANE COUNTY TREASURER DAVID J.

You can use Discover MasterCard Visa cards and also ACH for paying tax. That updated market value is then taken times a composite rate from all taxing entities together to calculate tax. The process was simple and uncomplicated.

Tax Extension 630-232-5964 John Emerson Director Robert J. The median property tax in Kane County is one of the highest in the country. Payments made online can take up to 72 hours to receive in Treasurers office.

Sandner Chief Deputy Clerk. If you are a new or. Karthik saved 38595 on his property taxes.

In LaSalle County Illinois. Kane County Treasurer Michael J. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online.

Accorded by state law the government of your city public schools and thousands of various special purpose units are given authority to evaluate real property market value fix tax rates. Kilbourne MBA would like to remind taxpayers the second installment of property tax is due on or before September 1 st. Kane County Treasurer 719 S.

A typical Kane County homeowner pays 6164 in property taxes. Kane County Real Estate Tax Bills Due September 1 2022. STATE OF ILLINOIS David J.

Kane County Connects Staff 8292022 500PM. RICKERT would like to remind taxpayers that the second installment of property. What if I pay my property tax online on the due date.

Kane county collects on average 209 of a. Kane County collects on average 209 of a propertys assessed fair. The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000.

Everything You Should Know About Your Kane County Tax Bill Lauren Jackson Law

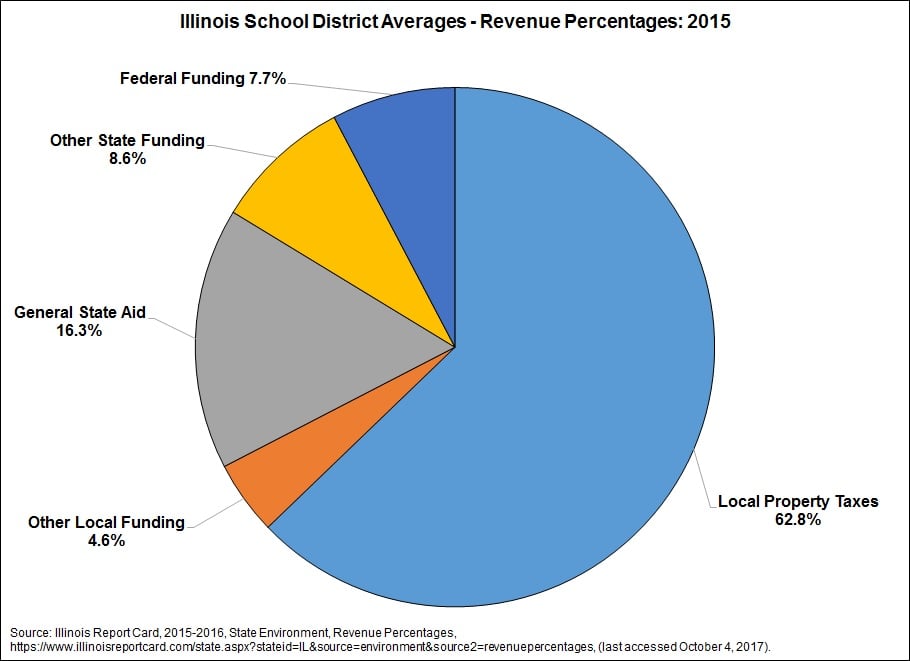

School Districts And Property Taxes In Illinois The Civic Federation

Probate Kane County Il Free Consultation 847 628 8311

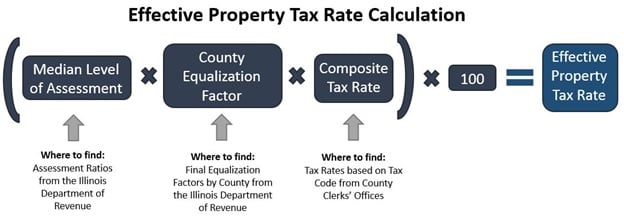

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Calculate Your Community S Effective Property Tax Rate The Civic Federation

![]()

Illinois Has The Highest Tax Rates In The Country Wallethub Study Kane County Reporter

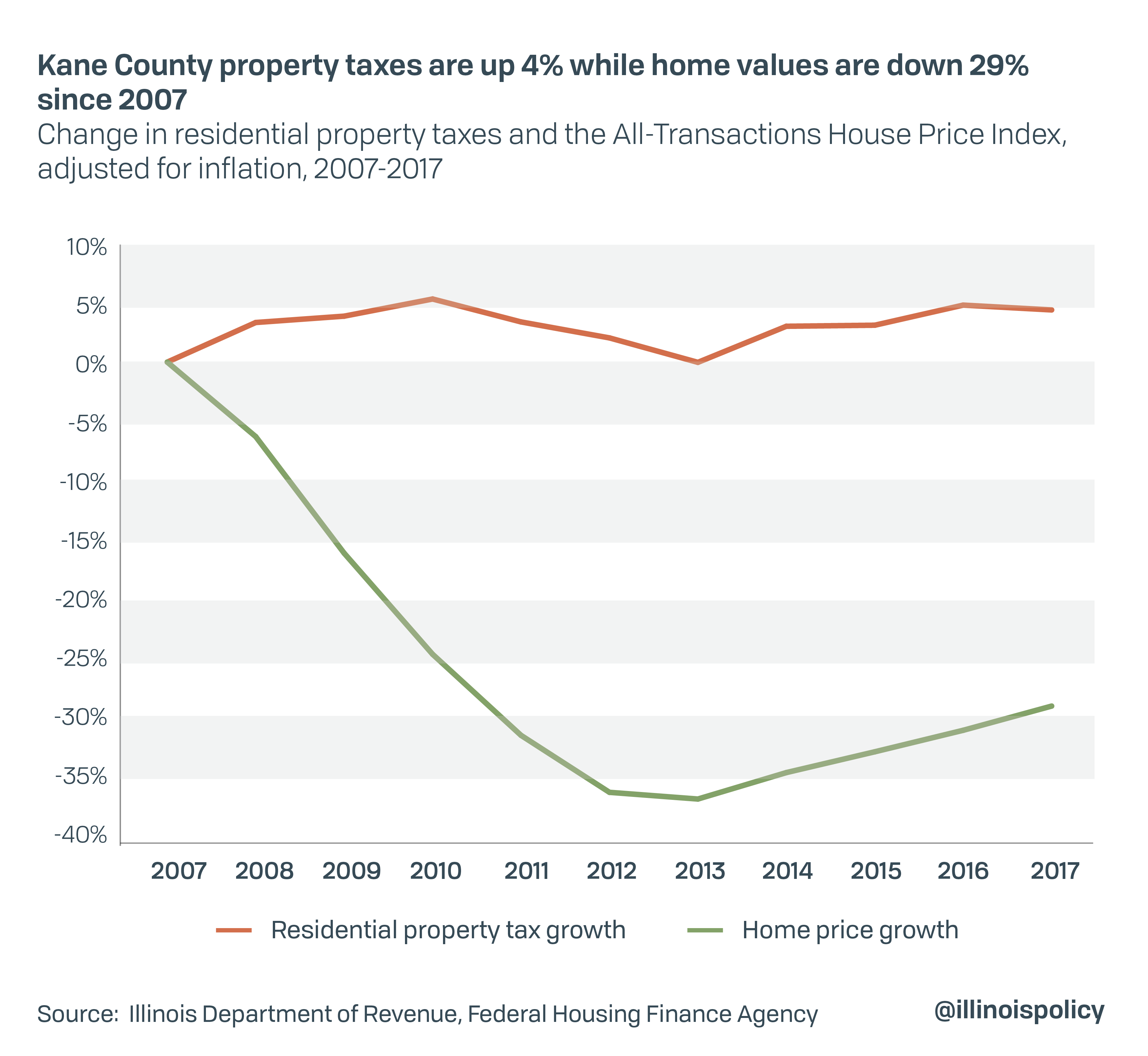

Kane County Home Values Down 29 Property Tax Up 4 Since Recession

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Mchenry Property Tax

Property Tax Bills Hit Kane County Mailboxes

Mchenry County Real Estate Tax Bill

Kane County Property Tax Appeals

Illinois Property Tax Calculator Smartasset

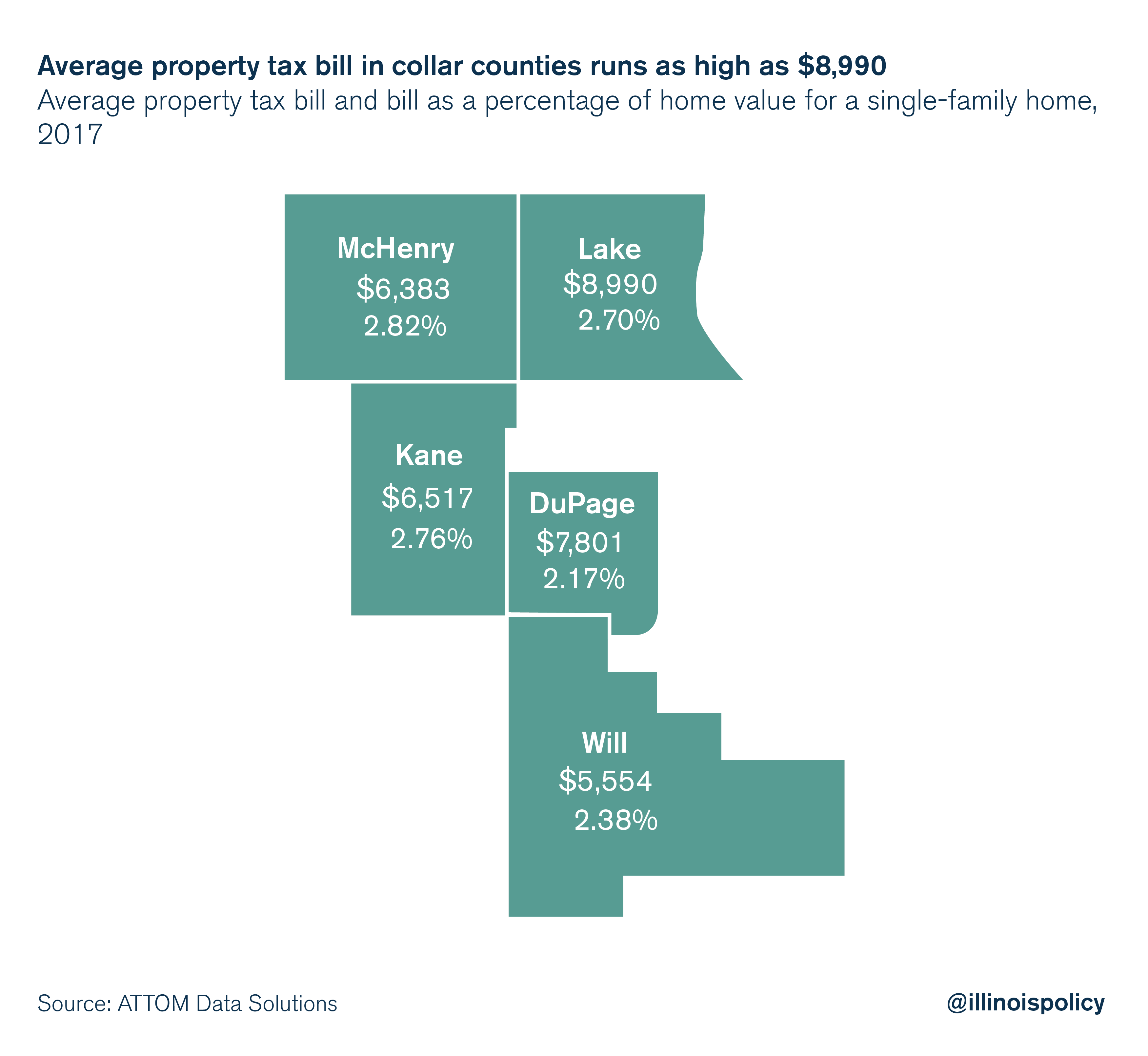

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Counties With The Cheapest Property Taxes In Illinois Neighborhood Loans

Wheeler Bill Sent To Pritzker Would Keep Property Taxes At A Minimum Kane County Reporter

Kane County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More